Fixed rate break cost calculator

Here Adam explains that even if the cost of breaking a loan may be high if the benefit of breaking makes sense it may be the best idea. If you pay your fixed rate mortgage early or make extra repayments you may be charged an exit fee.

Mortgage Break Fee Calculator Interest Co Nz

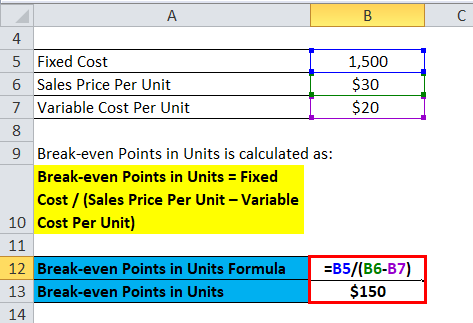

Q is the break even quantity F is.

. The one year inter-bank Market rate is now -04 in the market. Break Cost 500000. The amount that interest rates have moved since the start of.

If you prepay part of or your entire. Increase your loan also known as a top up You might want extra funds and decide to increase the limit of your fixed rate loan. The length of time remaining until your fixed rate expires.

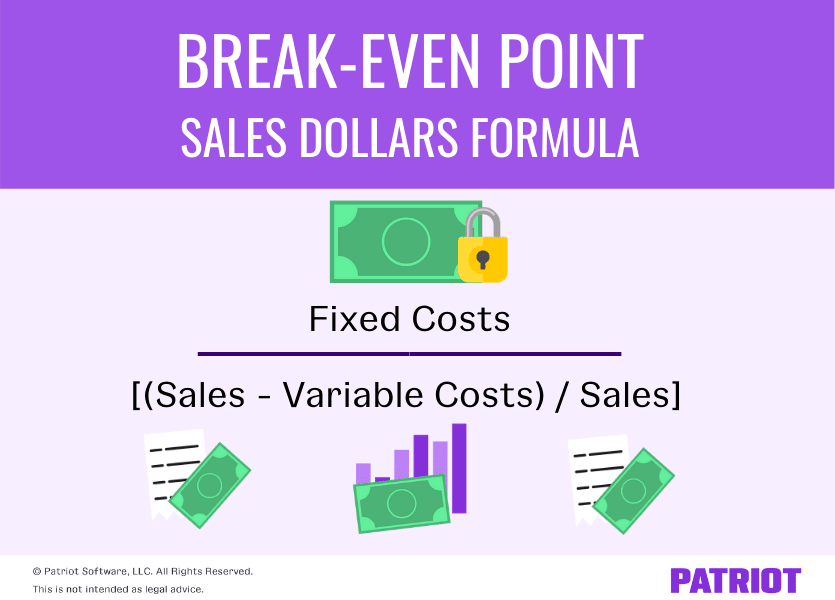

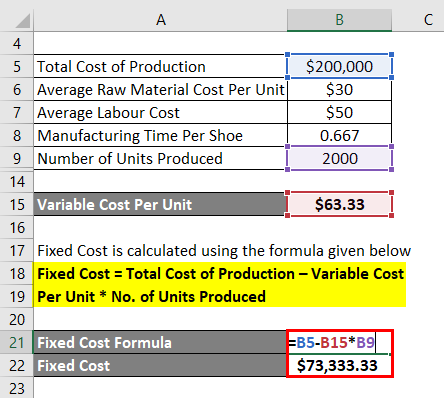

The Break Even Calculator uses the following formulas. Q F P V or Break Even Point Q Fixed Cost Unit Price Variable Unit Cost Where. A break cost is a fee that represents our loss if you repay your loan early or switch your product interest rate or payment type during a fixed rate period.

We can help you with all your break cost questions and give you a break cost quote if youre thinking of ending your fixed period early. The original wholesale interest rate when the fixed interest rate period started then a Break Cost will be charged. With an unchanging interest rate borrowers pay the adjustment amount each month for the entire fixed-rate period which usually calculators for one three or five.

Bank of Ireland can relend to the market at -04 instead of the 0 they borrowed at so the breakage fee is. Pay off some of your loan early. Say you take out a home loan of.

Use the break cost calculator to work out the costs. Call 1300 889 743 phone GET. During this time your lenders fixed rate was reduced to 5.

Break cost Loan amount x Change in Interest Rate x Time remaining on loan As an example lets say you borrowed 500000 on a fixed-rate home loan with a loan term of. Repay ahead of the due date or pay an. A break cost calculator estimates the break costs that could be charged on a fixed rate home loan if a borrower were to make a prepayment ie.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Using this example the difference between the original BBSR and the current rate is 05. For example if you ask us.

So if you have three years left on a fixed rate loan at 4 and the bank offers fixed rates at 3 for that term you can expect to break at 2 and then its 3 years x 2 difference. The difference between the wholesale interest rate at the start of the fixed. Break fees - Value not cost Loan amount Current.

The following example illustrates the formula used to calculate how the fixed rate unwind adjustment or fixed rate termination cost generally works. Call now or request a callback and well be back in. The amount you are paying off your fixed amount.

How To Calculate Fixed Cost With Examples Zippia

What Is The Break Even Point Definition Formula And Examples

Mortgage Points A Complete Guide Rocket Mortgage

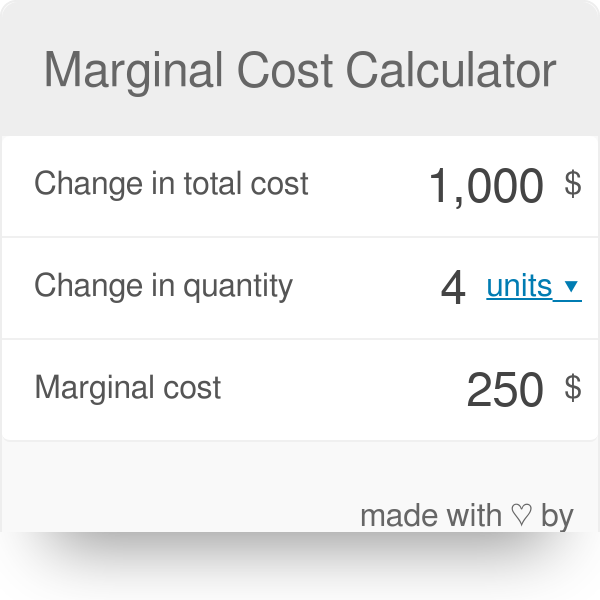

Marginal Cost Calculator

Fixed Rate Loans And Break Costs Break Cost Calculator Uno

Break Even Point Bep Formula And Calculator Excel Template

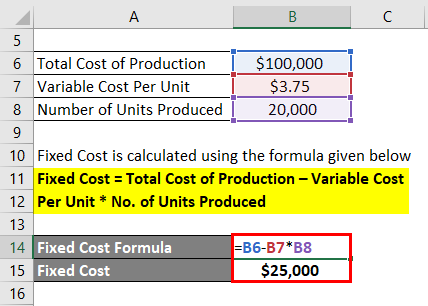

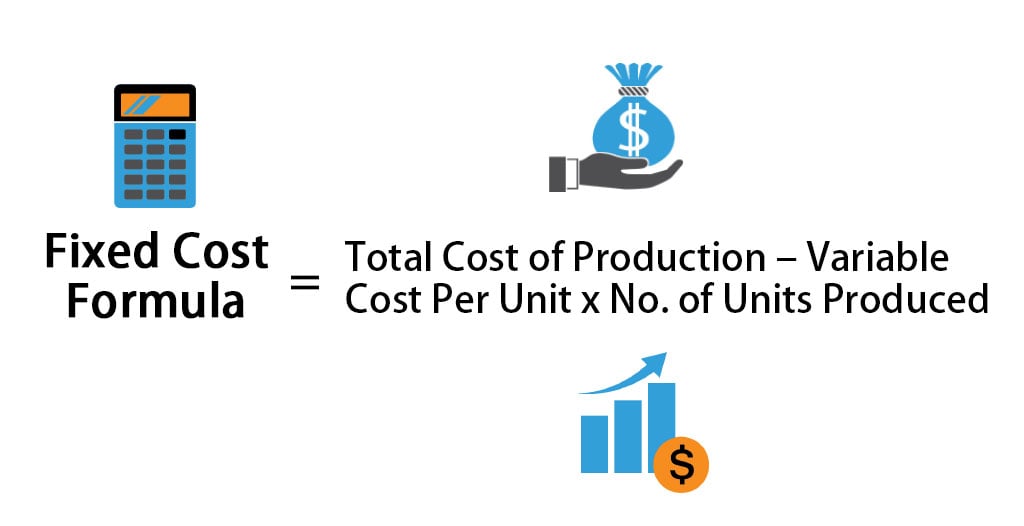

Fixed Cost Formula Calculator Examples With Excel Template

Fixed Cost Formula Calculator Examples With Excel Template

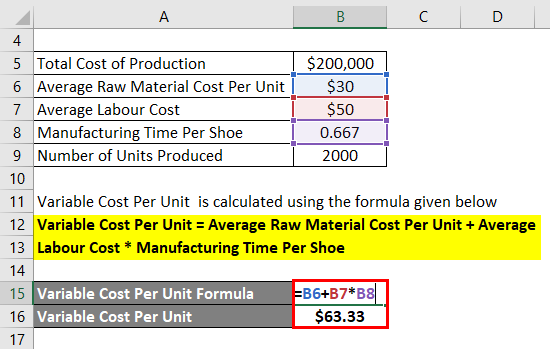

Variable Costing Formula Calculator Excel Template

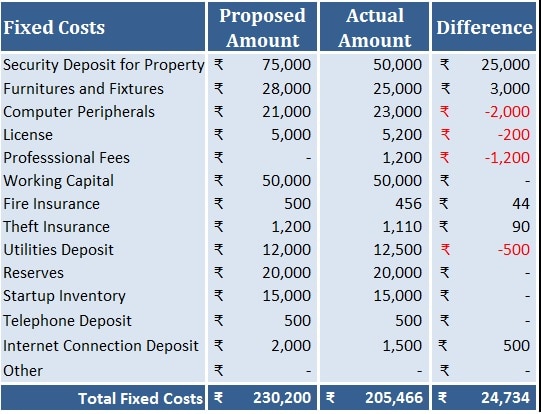

Download Startup Costs Calculator Excel Template Exceldatapro

Rental Property Calculator Most Accurate Forecast

Discount Points Calculator How To Calculate Mortgage Points

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Break Even Point Bep Formula And Calculator Excel Template

Fixed Cost Formula Calculator Examples With Excel Template

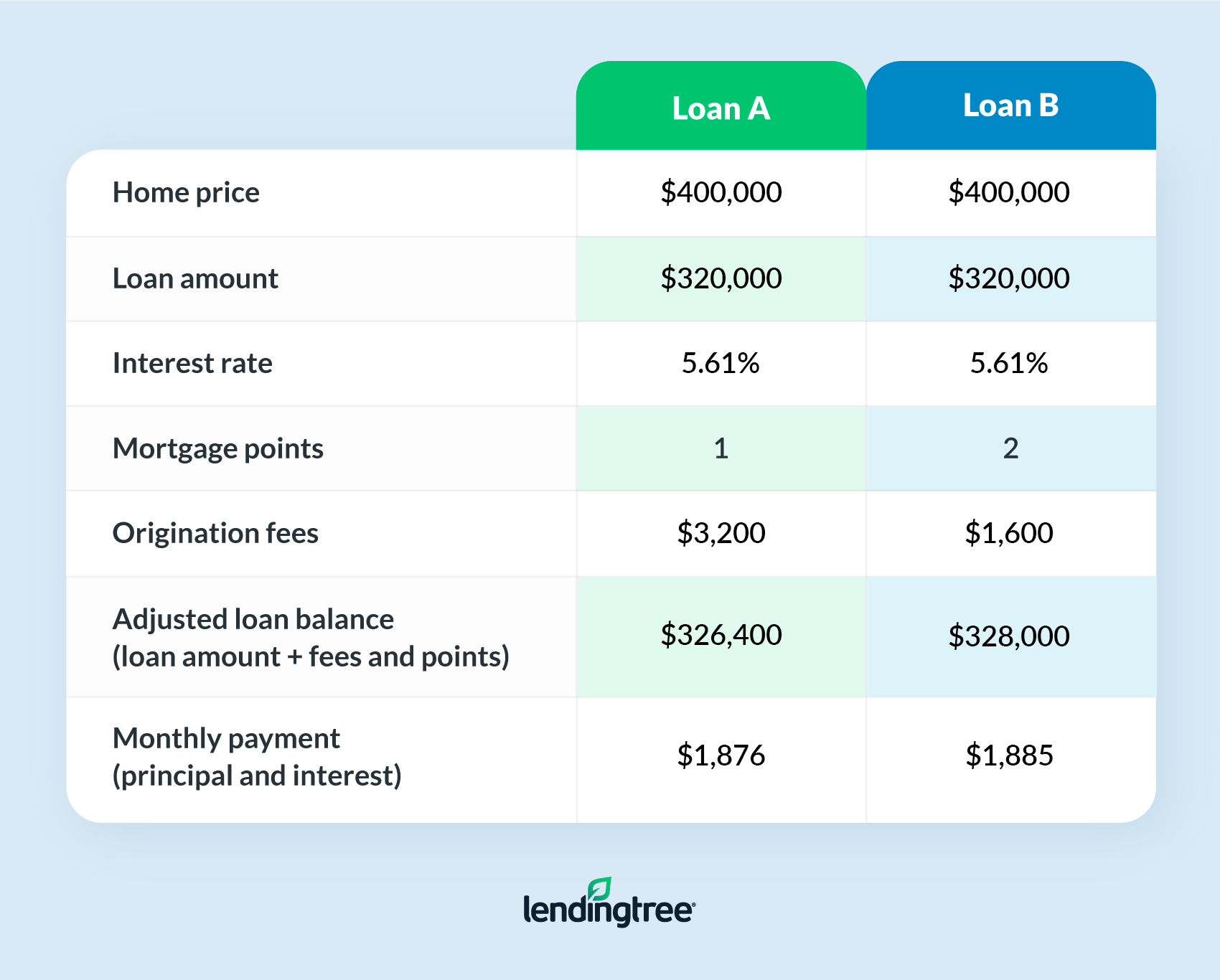

Apr Vs Interest Rate What S The Difference Lendingtree

Fixed Cost Formula Calculator Examples With Excel Template