30+ Mortgage calculator for 200000

In a 30-year fixed rate mortgage the interest payment that we make is probably very close to. In addition to the standard mortgage calculator this page lets you access more than 100 other.

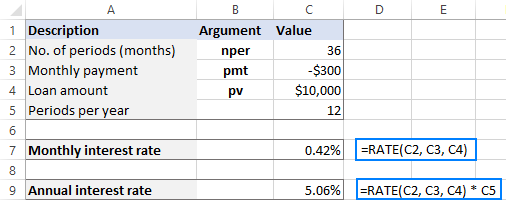

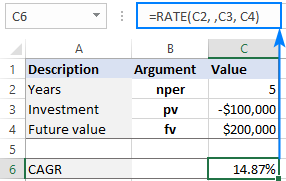

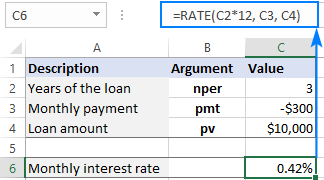

Using Rate Function In Excel To Calculate Interest Rate

What Mortgage Can I Afford Calculator.

. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

Most prospective borrowers choose either a 15. This calculator makes it easy to compare the monthly payments for any 2 fixed. See Terms and.

The AARP mortgage calculator can help you do just that. Use our free mortgage calculator to easily estimate your monthly payment. How to use this mortgage repayment calculator.

The most common mortgage terms are 15 years and 30 years. A 4 interest rate on a 200000 mortgage balance would add around 652 to your monthly payment. For example a 20 down payment on a 200000 house is 40000.

By default 250000 30-yr fixed-rate loans are displayed in the table below. Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer. See which type of mortgage is right for you and how much house you can afford.

A 30-year mortgage will repay at a different pace than a 15-year or 20-year mortgage. When you sign on for a 30-year mortgage you know youre in it for the long haul. Filters enable you to change the loan amount duration or loan type.

Check rates today to learn more about the latest 30-year mortgage rates. A home buyer makes when purchasing a home. Mortgage loans are originated by Space Coast Credit Union and are subject to credit approval verification and collateral evaluation.

Find and compare 30-year mortgage rates and choose your preferred lender. How much money could you save. An all-time low for rates.

Compare 15 30 Year Fixed Rate Mortgages. Borrowers within this limit typically receive more favourable mortgage rates. 200000 250000 300000 350000 400000 450000 500000 550000 600000 650000 700000.

The amount owed on the loan at the end of every month equals. You decide to increase your monthly payment by 1000. 200000 1 - 1 65 100 12 -30 12 126414.

Programs offers rates terms and conditions are subject to change or cancellation without notice. Your total interest on a 200000 mortgage. These other expenses can make up to 13 of the typical monthly expense on a 30-year mortgage so paying off a specified amount of debt in 15 years rather than 30 years may only represent a 30 to 35 larger total monthly.

The following derivation of this formula illustrates how fixed-rate mortgage loans work. Why not a 30-year mortgage. Estimate your monthly loan repayments on a 200000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

This entry is Required. Enter an amount between 0 and 25. Use our free mortgage calculator to easily estimate your monthly payment.

If you have a mortgage with a 30-year loan term and you opt to go interest-only for 5 years then you need to have the income to pay down the principal over a 25-year period. Our mortgage calculator helps you estimate your monthly mortgage payments. The longer the time horizon the less youll pay per month.

How long your loan lastsYou can choose the amount of time youll take to pay off your mortgagetypically 10 15 20 or 30 years. You can use a mortgage calculator to help you to find out this information specific to your current loan. Before you start punching numbers into a calculator however you need to have a budget.

Thats a lot of cabbage. Extra Payment Loan Types and Points. You might not even think about trying to pay off your mortgage early.

You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. Use this interest-only mortgage calculator to see what your payments would be on your interest-only mortgage in 2022. Include annual property tax homeowners insurance costs estimated mortgage interest rate and the loan terms or how long you want to pay off your mortgage.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. The Early-2017 Guide to Buying a Home March 10 2017. For instance if you had a 200000 mortgage and 20000 savings offset against it you only pay interest on 180000 of the mortgage.

Instead of paying say 3. A mortgage calculator is a great tool that you can use to see how much you can realistically afford. Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage.

And the other 200000 on PI. A mortgage calculator can help to add up all income sources and compare this to all monthly debt payments. Enter how much you want to borrow under Loan amount.

The monthly cost for a 200000 mortgage was about 1200 per month not including taxes and insurance Post 2008 rates declined steadily. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. A 20 down payment typically allows you to avoid.

Most UK lenders consider 20 to 30 a low-risk range. Annual interest rate for this mortgage. Put in any amount that you want from 10 to 1000 to find.

The prepayment mortgage calculator is like a combination of the mortgage payoff calculator and the early mortgage payoff calculator. The popular choice is 30 years but. The home loan calculator accounts for mortgage rates loan term down payment more.

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Take a look at the following example. Mortgage interest is amortized so that you pay the bulk of your interest in the first years of your mortgage.

If you currently have a 200000 mortgage loan and you have secured an interest rate at 65 percent your monthly payment is likely to be 1264 dollars per month if your loan term is 30 years. Early in the repayment period your monthly loan payments will include more interest. Freddie Mac During that time youll pay 200000 in principal plus another 125325 in interest for a total 325325.

You will get an amortization schedule on your new monthly payments with total principal and interest information. On a 30-year mortgage with a 4 fixed interest rate.

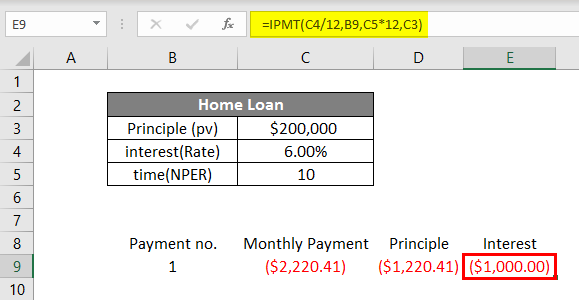

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How To Make Six Figures A Year And Still Not Feel Rich

Suppose A Loan Compounds Annually At The End Of The Year Loan Payments Are Also Made At The End Of The Year Which Is Applied First To The Principal The Compounding Interest

86 Of Americans Cannot Answer These Basic Financial Questions Can You Begin To Invest

Using Rate Function In Excel To Calculate Interest Rate

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

New Nyse Nrz Seeking Alpha

86 Of Americans Cannot Answer These Basic Financial Questions Can You Begin To Invest

86 Of Americans Cannot Answer These Basic Financial Questions Can You Begin To Invest

86 Of Americans Cannot Answer These Basic Financial Questions Can You Begin To Invest

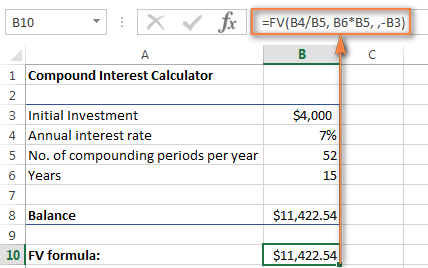

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Using Rate Function In Excel To Calculate Interest Rate

Increasing Passive Income Through Leverage And Arbitrage

Excel Mortgage Calculator How To Calculate Loan Payments In Excel